This month we look at the recent history of Disney and its famous leader, Bob Iger.

Tech Themes

Creative Trust. Bob began his career at ABC Television, eventually working his way into ABC Sports and their newly acquired Entertainment and Sports Programming Network (ESPN). Their Bob came under the toutalege of Roone Arledge, a famous broadcast executive known for his commitment to storytelling, and his lack of compassion for sub-par work. Bob saw first hand how Roone would get close to the start of production, only to make several last minute tweaks to the overall program, sometimes throwing out all of the work that had been done to offer the audience a better program. Bob understood this creative process was messy and inefficient, but crucial to producing high quality programming. After ABC was acquired by Capital Cities, Tom Murphy and Dan Burke promoted Iger into a new role as head of ABC entertainment. Upon being handed a stack of 40 scripts on his first day, Bob wondered what he was even supposed to be looking for in a script. “I started to realize over time, though, that I’d internalized a lot by watching Roone tell stories all those years.” In his first season as president, Iger decided to go ahead with an off-putting, creepy drama directed by David Lynch called Twin Peaks. At one point, Murphy was so concerned about airing the show, that he told Bob, “You can’t air this. If we put it on television, it will kill our company’s reputation.” Iger pushed back, enthralled that the creative community love the risk the network was taking. A 1990 New York Times article spells out the risky show’s language: “The offending usage was in a Wall Street Journal story about Robert Iger, a bold television producer: ''Even if 'Twin Peaks' caves in, it has already won ABC new cache in Hollywood as the hands-off network, eager for ideas that are daring and different.'' Iger learned early, it pays to take big and bold risks, especially with the creative community.

Bob Iger and Steve Jobs. One of the first things Bob Iger did when he became CEO of Disney was call Steve Jobs. Disney’s prior CEO, Michael Eisner, had spent years arguing a battle for who had the better legal position in the Disney-Pixar distribution relationship. Pixar had succeeded everyone’s wildest dreams with films like Toy Story, A Bug’s Life, and Finding Nemo, but Disney wanted full control of Pixar’s characters and the rights to film sequels. Iger describeds the kerfuffle: “Steve’s animosity toward Disney was too deep-rooted. The rift that had opened between Steve and Michael [Eisner] was a clash between two strong-willed people whose companies’ fortunes were going in different directions. When Disney Animation began to slip even further, Steve became more haughty with Michael because he flet we needed him more, and Michael hated that Steve had the upper hand.” Iger, ever the flatterer discussed with Jobs how he loved his iPod and wanted to put Disney shows on future generations of the device. Steve responded by showing Iger the new iPhone prototype they were developing. They agreed on a deal and Iger strode on stage at the iPod video launch in 2005. In his first board meeting as official CEO, Iger proposed buying Pixar. The company was half owned by Steve Jobs, who had bought it from his friend and Star Wars creator George Lucas for a measly $5 million (plus several $20-30m equity checks). After receiving approval from the board to look at an acquisition, Iger called Jobs from his car phone: “I’ve been thinking about our respective futures, What do you think about the idea of Disney buying Pixar?” Jobs responded - “You know, that’s not the craziest idea in the world.” A few weeks later, the two sat in the Apple boardroom sketching a simple pros and cons list on the whiteboard. For all of the math and financial analysis that goes into an acquisition, its hilariously to envision Steve and Bob doing what anyone would do to analyze an acquisition. “Two hours later, the pros were meager and the cons were abundant, even if a few of them, in my estimation were quite petty…’A few solid pros are more powerful than dozens of cons,’ Steve said." The agreement was negotiated an in 2006, Disney acquired Pixar for a $7.4B equity value. Right before the merger was announced, Steve took Bob for a walk around Apple’s campus, and told him that his cancer had returned. “He told me the cancer was now in his liver and he talked about the odds of beating it. He was going to do whatever it took to be at his son Reed’s high school graduation, he said. When he told me that was four years away, I felt devestated. It was impossible to be having these two conversations - about Steve facing his impending death and about the deal we were supposed to be closing in minutes - at the same time.” The deal ultimately closed and Jobs became Disney’s largest shareholder and a board member at the company, during which Disney’s stock performed very well.

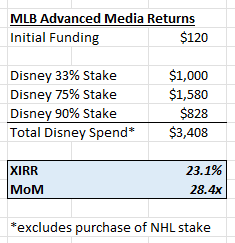

BamTECH. When Iger became CEO, he launched a three part plan to return Disney to the top of media and creativity. The plan was clear: “1) We needed to devote most of our time and capital to the creation of high quality branded content. 2) We needed to embrace technology to the fullest extent, first by using it to enable the creation of higher quality products, and then to reach more consumers in amore modern, more relevant ways. 3) We needed to become a truly global company.” If Pixar, Marvel, and Lucasfilm were an answer to part one, BAMTech was the answer to part two. Baseball Advanced Media Technologies was a company founded by Major League Baseball in 2000 to build out a digital radio streaming service for overseas listeners to the MLB playoffs. MLB Advanced Media was funded by a $1 million investment by each of its 30 teams for four consecutive years. Following a successful launch, BAMTech decided to try streaming live video of baseball games and launched MLB.tv, which soon became a major leader in streaming. Other leagues began to pay attention and soon the NHL had signed up BAMTech as its streaming partner, taking a 10% stake in the company. Soon ESPN, HBO, and the PGA Tour all signed on too. Disney used BAMTech as a back-end partner for the launch of its WatchESPN platform in 2010. So it was a natural extension for Iger, fresh off the massive success of the Pixar, Marvel, and Lucasfilm acquisitions, to try to buy the company. In 2015, BAMTech was officially spun out of the MLB, and in August 2016, Walt Disney acquired 33% of the company in August 2016 for $1B, valuing the streaming platform at $3B. In 2017, it upped its stake to 75% for another $1.58B, then in August 2021 it acquired the NHL’s 10% interest. Finally, it bought the remaining 15% interest from the MLB for $828m in October 2022. Amazing companies can come from anywhere. Based on some simple rough math, the MLB earned a 23% IRR on initial $120m investment from 2000 to 2022, a 28x return.

Business Themes

The Guide of Experience. Its clear that Bob Iger was molded into an incredible businessman through a series of experiences that almost no one could predict would create to such a compelling leader. Because Iger began in the TV industry at ABC, he began the habit of waking up absurdly early, a trait shared by many successful leaders. “To this day, I wake nearly every morning at four-fifteen, though now I do it for selfish reasons: to have time to think and read and exercise before the demands of the day take over.” After moving over to sports, Bob learned the importance of high quality from Roone Arledge, but he also developed one of his greatest traits, finding compromise among competing interests. “In 1979, the World Table Tennis Championships were being held in Pyongyang, North Korea. Roone called me into his office one day and said, ‘This is going to be interesting. Let’s cover it on Wide World of Sports.’ I thought he was joking. He surely knew it would be impossible to secure the rights to an event in North Korea. He wasn’t joking. I then embarked on a worldwide pursuit to secure the rights. After a few months of intense negotiations, we were on the eve of closing the deal when I received a call from someone on the Asian desk in the U.S. State Department. ‘Everything you are doing with them is illegal,’ he said. ‘You’re in violation of strict U.S. Sanctions against doing any business with North Korea…’ I eventually arrived at a workoaround that involved securing the rights not through the host country but through the World Table Tennis Federation. The North Korean government, though we were no longer paying them, still agreed to let us in, and we became the first U.S. media team to enter North Korea in decades - a historic moment in sports broadcasting.” When ABC was purchased by Capital Cities, Bob began his relationship with Dan Burke and Tom Murphy. Warren Buffett famously praised the pair: “Tom Murphy and [his long-time business partner] Dan Burke were probably the greatest two-person combination in management that the world has ever seen or maybe ever will see.” Iger learned tons about business, acquisitions, budgeting, and decentralized management from Tom and Dan. They also gave Iger numerous opportunities to prove himself and take risks, like the Twin Peaks launch. Later, when Cap Cities was acquired by Disney, Iger gained a front-row seat to Michael Eisner’s leadership style. Eisner was once regarded as one of the best CEOs in the world, but languished as the stress of managing a massive company caused him to become increasingly defensive and depressed. Despite sharing a complicated relationship, Iger learned a lot about managing Disney from Eisner, including what he didn’t want to do once he got the role. In hindsight, its no surprise that Iger became the leader he became, even though it wasn’t clear as it was unfolding.

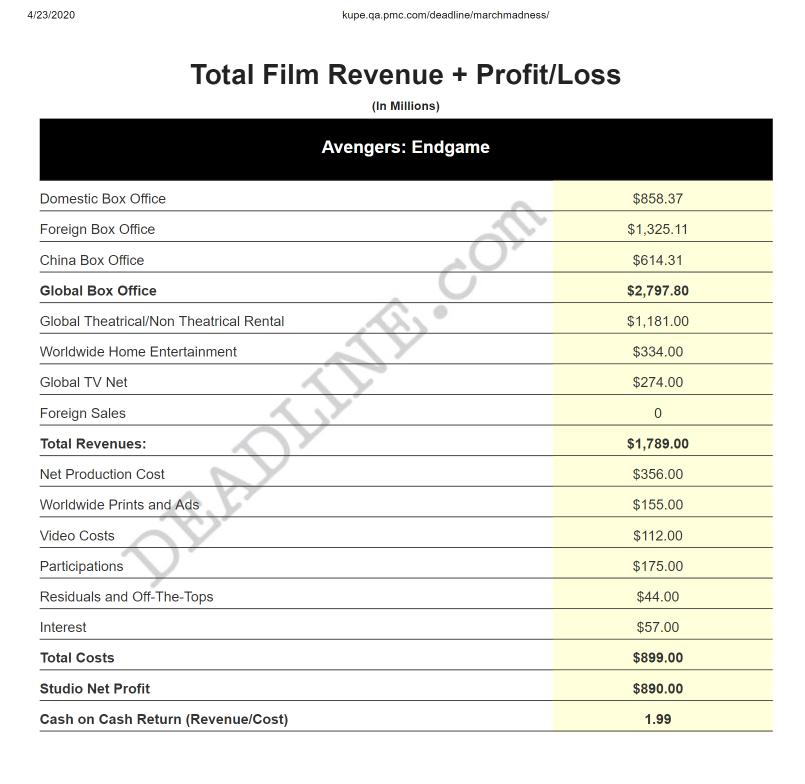

A tale of M&A. Although Disney sticks in people’s minds as a family friendly media company, its sprawling empire has grown to include ABC, ESPN, Marvel, the Simpsons, Star Wars, Pixar, Marvel, Hotstar, National Geographic, Hulu, 20th Century Studios, X-Men, Deadpool, Fx, Disney World, Disney Cruise Line, and Disney+. This empire was constructed through many M&A deals. The first major M&A deal was the 1995 $19B Disney, Capital Cities merger, which was the second largest corporate takeover (to KKR’s RJR Nabisco LBO) ever. Warren Buffett became one of the largest shareholders of Disney, which he sold over the next few years, only to massively miss out on the growth of ESPN and eventually the content domination that Iger began. The deal took a while to digest, and vastly expanded Disney’s operations. Eisner’s legendarily poor hire of talent agent Michael Ovitz compounded pressures, and Eisner relied even more heavily on Disney’s Strategic Planning group to make corporate decisions. From 1995 to 2005, Disney’s stock increased only 25%, and Eisner was forced out in a brutal, public proxy battle. Once Iger took over, he collapsed the Strat Planning department under rising star Kevin Mayer, and began the series of acquisitions that marked his tenure. After Pixar, Iger turned to Marvel, which was stumbling along as a comic book and toy producer to a shrinking population of interested buyers. Despite its relatively small size, Marvel had a fascinating corporate history. In the late 80’s, Ron Perelman, billionaire businessman, bought Marvel for a mere $82m. However, after the comic book boom faded, Marvel fell into bankruptcy, and Icahn stepped in to buy Marvel’s distressed debt eventually becoming chairman of the board through a protracted legal process. At the last second, Ike Perlmutter and Avi Arad, managers of the largest susidiary of Marvel, Toy Biz, proposed a better offer to the bankruptcy court, and eventually wrestled control away from both Perelman and Icahn. By the time Disney came knocking in 2008, Marvel was beginning to produce its own films, after several successful Spider-Man and X-men films. While a lot of Disney executives believed Marvel was too edgy for Disney, Iger took a longer term view and bought the company for $4B, which has clearly paid off. Alongside the acquisition of Marvel, Disney invested about $100m for a 30% stake in a new streaming service created by NBC and News Corp called Hulu. Next, Iger turned to Lucasfilm, the maker of Star Wars. George Lucas was very reluctant to sell to Disney, and it took four and half years of convincing: “We went over and over the same ground - George saying he couldn’t just hand over his legacy, me saying we couldn’t buy it and not control it - and twice walked away from the table and called the deal off. (We walked the first time and George walked the second).” Eventually, Disney acquired Lucasfilm for $4.05B, another great content acquisition that has worked out well. While Iger is credited with these amazing acquisitions, his latest and biggest acquisition has raised the most questions for Disney. In 2017, Disney announced it would buy 20th Century Fox for $52B in stock, and the assumption of $13.7B of Fox’s net debt. However, the deal faced a long regulatory approval process, during which the US Justice Department ruled in favor of AT&T buying Time Warner. With what seemed like a favorable M&A environment, Comcast entered the fray, proposing an all cash bid at $35 a share or $64B. Disney upped its offer to $38 a share, half in cash and half in stock. Fox accepted Disney’s new bid (of $71B), and Disney closed the deal in March of 2019. While the deal did bring X-men, Deadpool, Fantastic Four, the Simpsons, Family Guy, it added $19B of debt to its balance sheet. In addition, Disney spent time selling Fox’s Sky ownership to Comcast, and the regional sports networks owned by Fox. These divestitures were necessary for the regulatory approval of the deal and netted Disney $24B ($15B from Sky and $9.6B from the sports networks). Covid through Disney for a loop, and its higher leverage from the Fox deal, caused the elimination of its dividend, and an obvious massive reduction to its parks business. Time will tell if the Fox Deal yields the same great results that Pixar, Marvel, and Lucasfilm produced - I wonder if this wasn’t too big for the integration risk entailed.

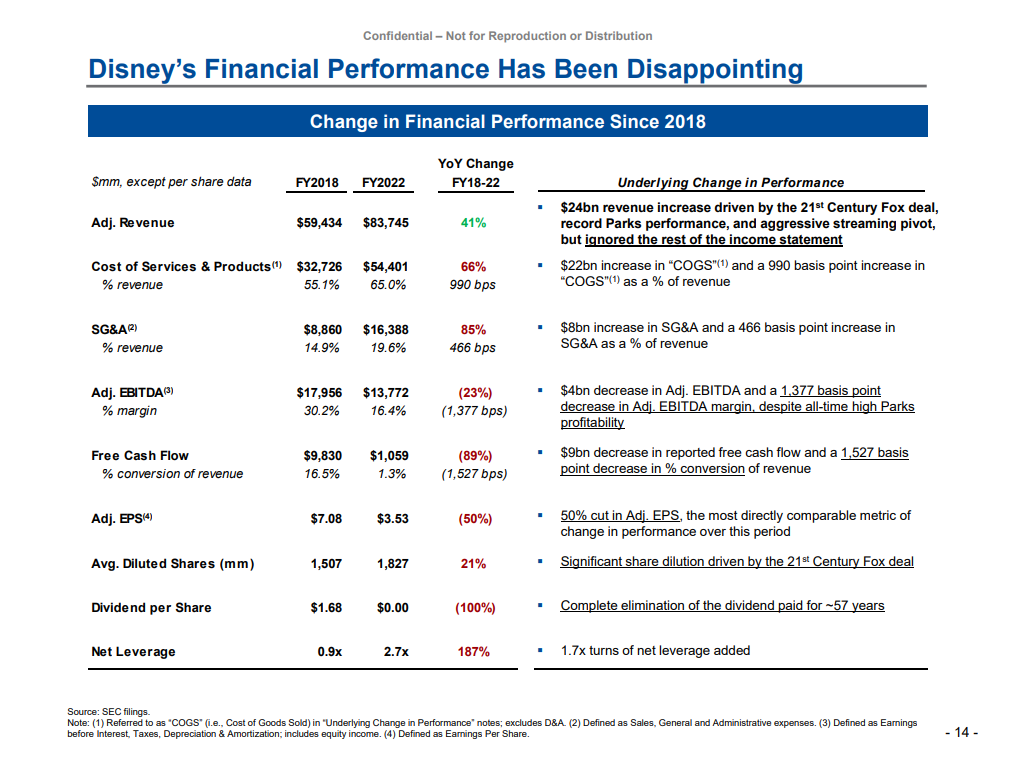

Walt Proxy. Disney has a rich history in not only animated characters but business characters as well. The company has repeatedly been subject to proxy battles. Iger’s first proxy battle began slowly then grew into a massive public boardroom debate. In 2002, Roy E. Disney and Stanley Gold, expressed their disappointment in Michael Eisner’s choices as CEO of Disney, sending a letter to the board demanding his removal. Eisner retailiated, “turning to the company’s governance guidlines regarding board member tenure, which stipulated that board members had to retire at age seventy-two. Rather than telling Roy himself, though, Michael had the chairman of the board’s nominating committee inform him that he would not be allowed to stand for reeelection and would be retired as of the next shareholders meeting in March 2004.” Roy began a public campaign called “Save Disney” where he called for Michael’s retirement and for him to rejoin the board. At the same time, Comcast launched a hostile bid for Disney. While Comcast would eventually find its content companion in NBC/Universal years later, this bid added heat to the situation. Comcast was unable to complete its bid, but the shareholder vote still turned out poorly for Eisner, with 43% of shareholders withholding support for him as CEO. He was promptly stripped of his chairman title, and in the fall of 2004, announced his resignation at the end of his contract in 2006. Fast forward to 2023, and Disney is back in the proxy battle world, this time facing up against Nelson Peltz, the famous activist investor. Under scrutiny are Disney’s acquisition of Fox, its exorbitant streaming losses, the cancellation of its dividend, the massive debt load it carries, and its large Netflix-competing content spend. The board recently announced that Iger would come back as CEO, despite clearly saying his time was over in the book. Iger’s successor, Bob Chapek, had a terrible run as Disney CEO, including shutting down the company, a public row with the State of Florida and Scarlett Johansson, and a centralization process that took control away from the creatives. I guess the Ride of a Lifetime is not over.

Dig Deeper