This month we review the technology classic, the Innovator’s Dilemma, by Clayton Christensen. The book attempts to answer the age-old question: why do dominant companies eventually fail?

Tech Themes

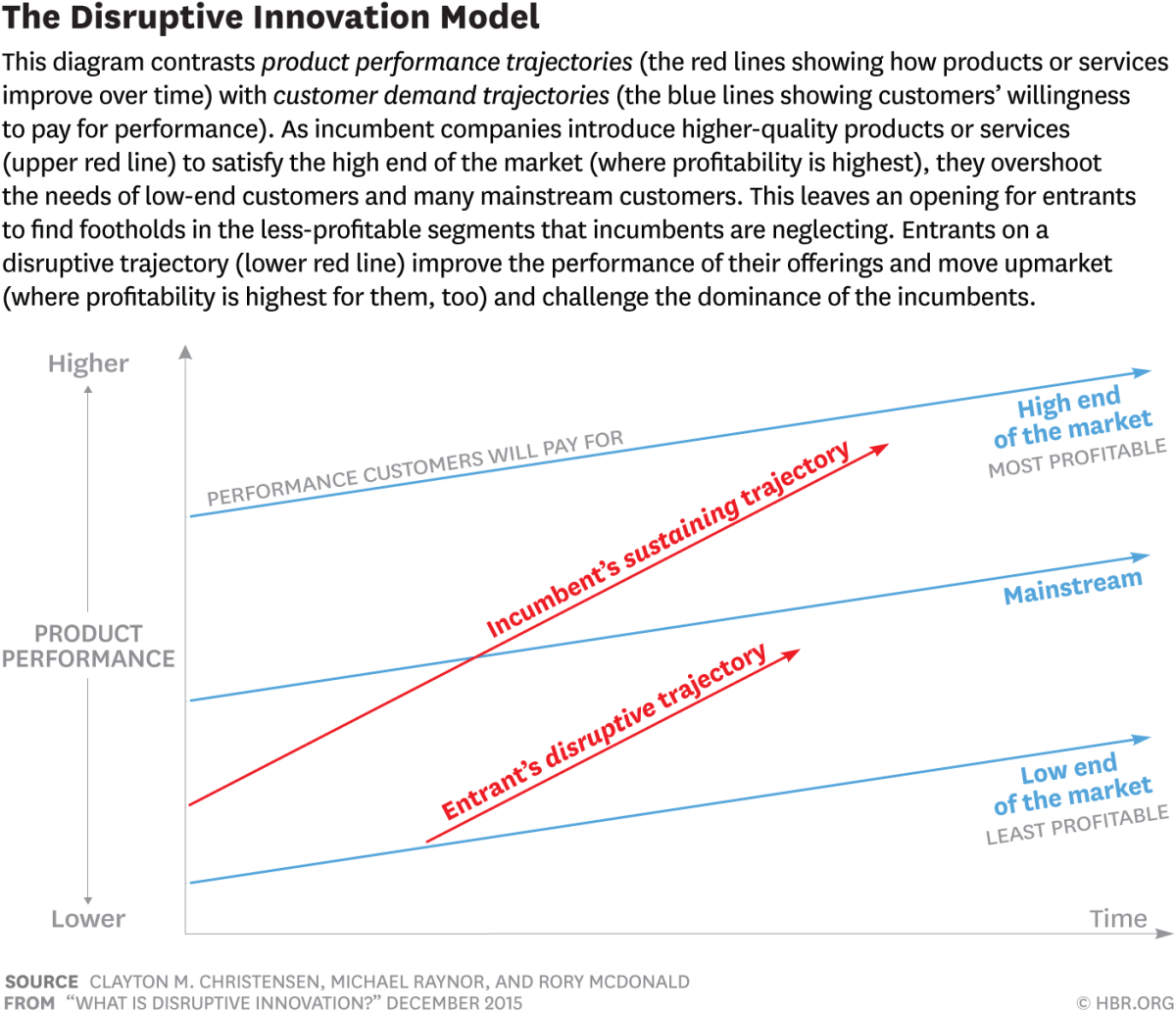

The Actual Definition of Disruptive Technology. Disruption is a term that is frequently thrown around in Silicon Valley circles. Every startup thinks its technology is disruptive, meaning it changes how the customer currently performs a task or service. The actual definition, discussed in detail throughout the book, is relatively specific. Christensen re-emphasizes this distinction in a 2015 Harvard Business Review article: "Specifically, as incumbents focus on improving their products and services for their most demanding (and usually most profitable) customers, they exceed the needs of some segments and ignore the needs of others. Entrants that prove disruptive begin by successfully targeting those overlooked segments, gaining a foothold by delivering more-suitable functionality—frequently at a lower price. Incumbents, chasing higher profitability in more-demanding segments, tend not to respond vigorously. Entrants then move upmarket, delivering the performance that incumbents' mainstream customers require, while preserving the advantages that drove their early success. When mainstream customers start adopting the entrants' offerings in volume, disruption has occurred." The book posits that there are generally two types of innovation: sustaining and disruptive. While disruptive innovation focuses on low-end or new, small market entry, sustaining innovation merely continues markets along their already determined axes. For example, in the book, Christensen discusses the disk drive industry, mapping out the jumps which pack more memory and power into each subsequent product release. There is a slew of sustaining jumps for each disruptive jump that improves product performance for existing customers but doesn't necessarily get non-customers to become customers. It is only when new use cases emerge, like rugged disk usage and PCs arrive, that disruption occurs. Understanding the specific definition can help companies and individuals better navigate muddled tech messaging; Uber, for example, is shown to be a sustaining technology because its market already existed, and the company didn't offer lower prices or a new business model. Understanding the intricacies of the definition can help incumbents spot disruptive competitors.

Value Networks. Value networks are an underappreciated and somewhat confusing topic covered in The Innovator's Dilemma's early chapters. A value network is defined as "The context within which a firm identifies and responds to customers' needs, solves problems, procures input, reacts to competitors, and strives for profit." A value network seems all-encompassing on the surface. In reality, a value network serves to simplify the lens through which an organization must make complex decisions every day. Shown as a nested product architecture, a value network attempts to show where a company interacts with other products. By distilling the product down to its most atomic components (literally computer hardware), we can see all of the considerations that impact a business. Once we have this holistic view, we can consider the decisions and tradeoffs that face an organization every day. The takeaway here is that organizations care about different levels of performance for different products. For example, when looking at cloud computing services at AWS, Azure, or GCP, we see Amazon EC2 instances, Azure VMs, and Google Cloud VMs with different operating systems, different purposes (general, compute, memory), and different sizes. General-purpose might be fine for basic enterprise applications, while gaming applications might need compute-optimized, and real-time big data analytics may need a memory-optimized VM. While it gets somewhat forgotten throughout the book, this point means that organizations focused on producing only compute-intensive machines may not be the best for memory-intensive, because the customers of the organization may not have a use for them. In the book's example, some customers (of bigger memory providers) looked at smaller memory applications and said there was no need. In reality, there was massive demand in the rugged, portable market for smaller memory disks. When approaching disruptive innovation, it's essential to recognize your organization's current value network so that you don't target new technologies at those who don't need it.

Product Commoditization. Christensen spends a lot of time describing the dynamics of the disk drive industry, where companies continually supplied increasingly smaller drives with better performance. Christensen's description of commoditization is very interesting: "A product becomes a commodity within a specific market segment when the repeated changes in the basis of competition, completely play themselves out, that is, when market needs on each attribute or dimension of performance have been fully satisfied by more than one available product." At this point, products begin competing primarily on price. In the disk drive industry, companies first competed on capacity, then on size, then on reliability, and finally on price. This price war is reminiscent of the current state of the Continuous Integration / Continuous Deployment (CI/CD) market, a subsegment of DevOps software. Companies in the space, including Github, CircleCI, Gitlab, and others are now competing primarily on price to win new business. Each of the cloud providers has similar technologies native to their public cloud offerings (AWS CodePipeline and CloudFormation, GitHub Actions, Google Cloud Build). They are giving it away for free because of their scale. The building block of CI/CD software is git, an open-source version control system founded by Linux founder Linus Torvalds. With all the providers leveraging a massive open-source project, there is little room for true differentiation. Christensen even says: "It may, in fact, be the case that the product offerings of competitors in a market continue to be differentiated from each other. But differentiation loses its meaning when the features and functionality have exceeded what the market demands." Only time will tell whether these companies can pivot into burgeoning highly differentiated technologies.

Business Themes

Resources-Processes-Value (RPV) Framework. The RPV framework is a powerful lens for understanding the challenges that large businesses face. Companies have resources (people, assets, technology, product designs, brands, information, cash, relationships with customers, etc.) that can be transformed into greater value products and services. The way organizations go about converting these resources is the organization's processes. These processes can be formal (documented sales strategies, for example) or informal (culture and habitual routines). Processes are the big reasons organizations struggle to deal with emerging technologies. Because culture and habit are ingrained in the organization, the same process used to launch a mature, slow-growing market may be applied to a fast-growing, dynamic sector. Christensen puts it best: "This means the very mechanisms through which organizations create value are intrinsically inimical to change." Lastly, companies have values, or "the standards by which employees make prioritization decisions." When there is a mismatch between the resources, processes, and values of an organization and the product or market that an organization is chasing, its rare the business can be successful in competing in the disruptive market. To see this misalignment in action, Christensen describes a meeting with a CEO who had identified the disruptive change happening in the disk-drive market and had gotten a product to market to meet the growing market. In response to a publication showing the fast growth of the market, the CEO lamented to Christensen: "I know that's what they think, but they're wrong. There isn't a market. We've had that drive in our catalog for 18 months. Everyone knows we've got it, but nobody wants it." The issue was not the product or market demand, but the organization's values. As Christensen continues, "But among the employees, there was nothing about an $80 million, low-end market that solved the growth and profit problems of a multi-billion dollar company – especially when capable competitors were doing all they could to steal away the customers providing those billions. And way at the other end of the company there was nothing about supplying prototype companies of 1.8-inch drives to an automaker that solved the problem of meeting the 1994 quotas of salespeople whose contacts and expertise were based so solidly in the computer industry." The CEO cared about the product, but his team did not. The RPV framework helps evaluate large companies and the challenges they face in launching new products.

How to manage through technological change. Christensen points out three primary ways of managing through disruptive technology change: 1. "Acquire a different organization whose processes and values are a close match with the new task." 2. "Try to change the processes and values of the current organization." 3. "Separate out an independent organization and develop within it the new processes and values that are required to solve the new problem." Acquisitions are a way to get out ahead of disruptive change. There are so many examples but two recent ones come to mind: Microsoft's acquisition of Github and Facebook's acquisition of Instagram. Microsoft paid a whopping $7.5B for Github in 2018 when the Github was rumored to be at roughly $200M in revenue (37.5x Revenue multiple!). Github was undoubtedly a mature business with a great product, but it didn't have a ton of enterprise adoption. Diane Greene at Google Cloud, tried to get Sundar Pichai to pay more, but he said no. Github has changed Azure's position within the market and continued its anti-Amazon strategy of pushing open-source technology. In contrast to the Github acquisition, Instagram was only 13 employees when it was acquired for $1B. Zuckerberg saw the threat the social network represented to Facebook, and today the acquisition is regularly touted as one of the best ever. Instagram was developing a social network solely based on photographs, right at the time every person suddenly had an excellent smartphone camera in their pocket. The acquisition occurred right when the market was ballooning, and Facebook capitalized on that growth. The second way of managing technological change is through changing cultural norms. This is rarely successful, because you are fighting against all of the processes and values deeply embedded in the organization. Indra Nooyi cited a desire to move faster on culture as one of her biggest regrets as a young executive: "I’d say I was a little too respectful of the heritage and culture [of PepsiCo]. You’ve got to make a break with the past. I was more patient than I should’ve been. When you know you have to make a change, at some point you have to say enough is enough. The people who have been in the company for 20-30 years pull you down. If I had to do it all over again, I might have hastened the pace of change even more." Lastly, Christensen prescribes creating an independent organization matched to the resources, processes, and values that the new market requires. Three great spin-out, spin-in examples with different flavors of this come to mind. First, Cisco developed a spin-ins practice whereby they would take members of their organization and start a new company that they would fund to develop a new process. The spin-ins worked for a time but caused major cultural issues. Second, as we've discussed, one of the key reasons AWS was born was that Chris Pinkham was in South Africa, thousands of miles away from Amazon Corporate in Seattle; this distance and that team's focus allowed it to come up with a major advance in computing. Lastly, Mastercard started Mastercard Labs a few years ago. CEO Ajay Banga told his team: "I need two commercial products in three years." He doesn't tell his CFO their budget, and he is the only person from his executive team that interacts with the business. This separation of resources, processes, and values allows those smaller organizations to be more nimble in finding emerging technology products and markets.

Discovering Emerging Markets.

The resources-processes-values framework can also show us why established firms fail to address emerging markets. Established companies rely on formal budgeting and forecasting processes whereby resources are allocated based on market estimates and revenue forecasts. Christensen highlights several important factors for tackling emerging markets, including focusing on ideas, failure, and learning. Underpinning all of these ideas is the impossibility of predicting the scale and growth rate of disruptive technologies: "Experts' forecasts will always be wrong. It is simply impossible to predict with any useful degree of precision how disruptive products will be used or how large their markets will be." Because of this challenge, relying too heavily on these estimates to underpin financial projections can cause businesses to view initial market development as a failure or not worthy of the companies time. When HP launched a new 1.3-inch disk drive, which could be embedded in PDAs, the company mandated that its revenues had to scale up to $150M within three years, in line with market estimates. That market never materialized, and the initiative was abandoned as a failed investment. Christensen argues that because disruptive technologies are threats, planning has to come after action, and thus strategic and financial planning must be discovery-based rather than execution-based. Companies should focus on learning their customer's needs and the right business model to attack the problem, rather than plan to execute their initial vision. As he puts it: "Research has shown, in fact, that the vast majority of successful new business ventures, abandoned their original business strategies when they began implementing their initial plans and learned what would and would not work." One big fan of Christensen's work is Jeff Bezos, and its easy to see why with Amazon's focus on releasing new products in this discovery manner. The pace of product releases is simply staggering (~almost one per day). Bezos even talked about this exact issue in his 2016 shareholder letter: "The senior team at Amazon is determined to keep our decision-making velocity high. Speed matters in business – plus a high-velocity decision making environment is more fun too. We don't know all the answers, but here are some thoughts. First, never use a one-size-fits-all decision-making process. Many decisions are reversible, two-way doors. Those decisions can use a light-weight process. For those, so what if you're wrong? I wrote about this in more detail in last year's letter. Second, most decisions should probably be made with somewhere around 70% of the information you wish you had. If you wait for 90%, in most cases, you're probably being slow." Amazon is one of the first large organizations to truly embrace this decision-making style, and clearly, the results speak for themselves.