This month we read Carlota Perez’s understudied book covering the history of technology breakthroughs and revolutions. This book marries the role of financing and technology breakthrough so seamlessly in an easy to digest narrative style.

Tech Themes

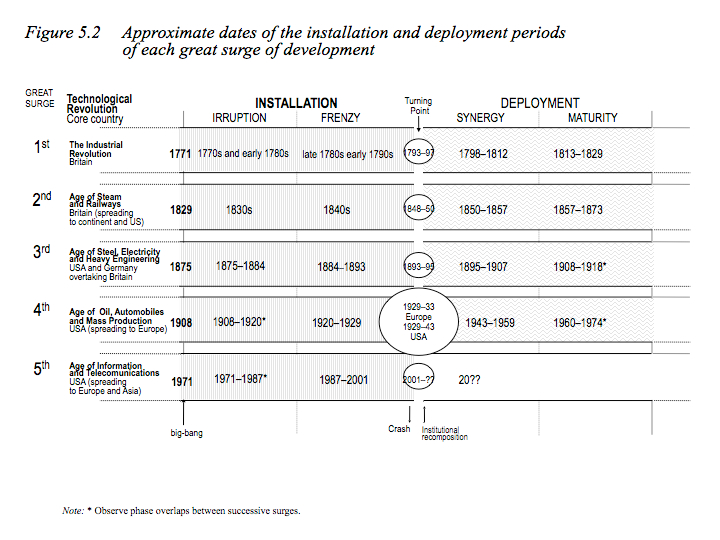

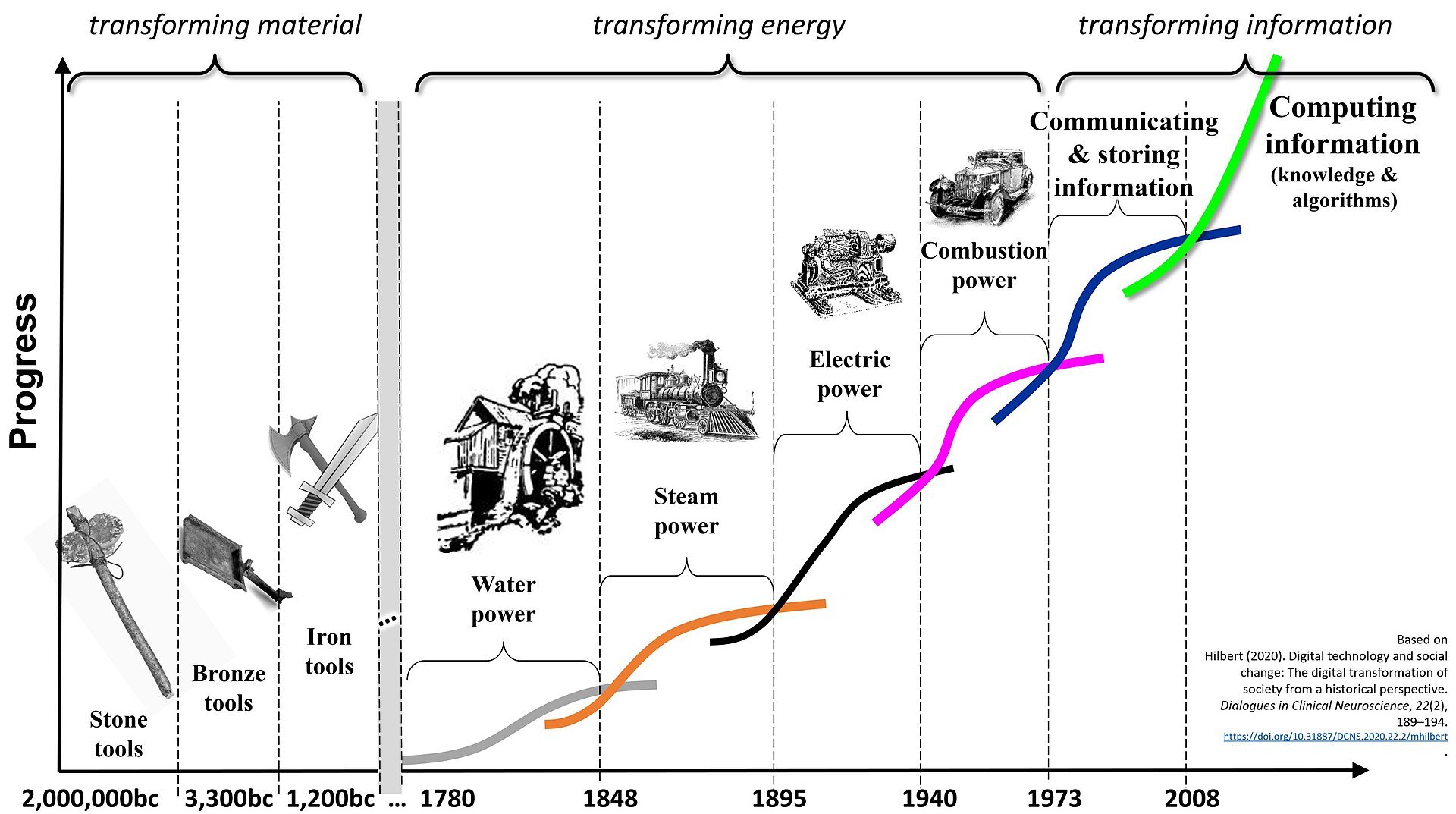

The 5 Technology Revolutions. Perez identifies the five major technological revolutions: The Industrial Revolution (1771-1829), The Age of Steam and Railways (1829-1873), The Age of Steel, Electricity and Heavy Engineering (1875-1918), The Age of Oil, the Automobile and Mass Production (1908-1974), and The Age of Information and Telecommunications (1971-Today). When looking back at these individual revolutions, one can recognize how powerful it is to view the world and technology in these incredibly long waves. Many of these periods lasted for over fifty years while their geographic dispersion and economic effects fully came to fruition. These new technologies fundamentally alter society - when it becomes clear that the revolution is happening, many people jump on the bandwagon. As Perez puts it, “The great clusters of talent come forth after the evolution is visible and because it is visible.” Each revolution produces a myriad of change in society. The industrial revolution popularized factory production, railways created national markets, electricity created the power to build steel buildings, oil and cars created mass markets and assembly lines, and the microprocessor and internet created amazing companies like Amazon and Airbnb.

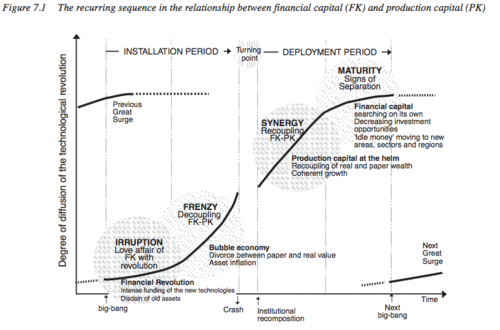

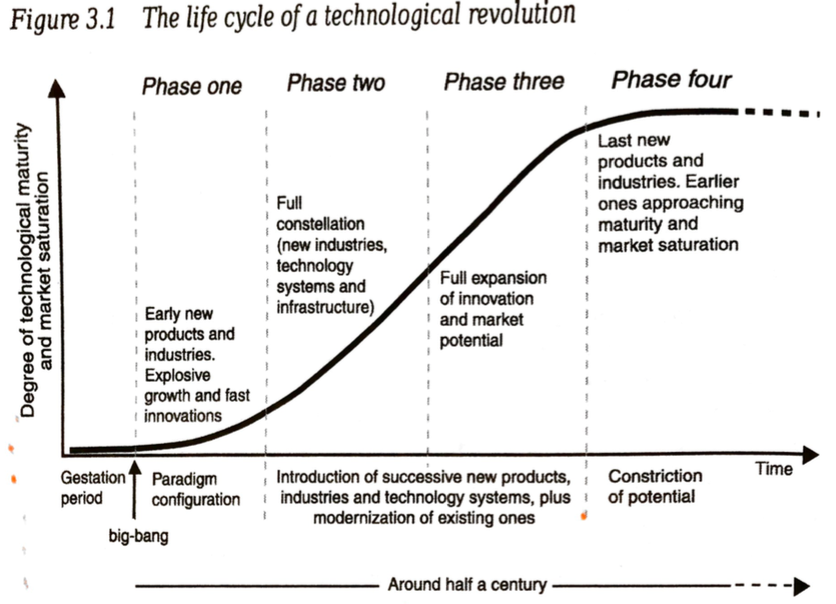

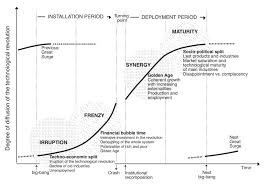

The Phases of Technology Revolution. After a decently long gestation period during which the old revolution has permeated across the world, the new revolution normally starts with a big bang, some discovery or breakthrough (like the transistor or steam engine) that fundamentally pushed society into a new wave of innovation. Coupled with these big bangs, is re-defined infrastructure from the prior eras - as an example, the Telegraph and phone wires were created along the initial railways, as they allowed significant distance of uninterrupted space to build on. Another example is electricity - initially, homes were wired to serve lightbulbs, it was only many years later that great home appliances came into use. This initial period of application discovery is called the Irruption phase. The increasing interest in forming businesses causes a Frenzy period like the Railway Mania or the Dot-com Boom, where everyone thinks they can get rich quick by starting a business around the new revolution. As the first 20-30 years of a revolution play themselves out, there grows a strong divide between those who were part of the revolution and those who were not; there is an economic, social, and regulatory mismatch between the old guard and the new revolution. After an uprising (like the populism we have seen recently) and bubble collapse (Check your crystal ball), regulatory changes typically foster a harmonious future for the technology. Following these changes, we enter the Synergy phase, where technology can fully flourish due to accommodating and clear regulation. This Synergy phase propagates outward across all countries until even the lagging adopters have started the adoption process. At this point the cycle enters into Maturity, waiting for the next big advance to start the whole process over again.

Where are we in the cycle today? We tweeted at Carlota Perez to answer this question AND SHE RESPONDED! My question to Perez was: With the recent wave of massive, transformational innovation like the public cloud providers, and the iPhone, are we still in the Age of Information? These technological waves are often 50-60 years and yet we’ve arguably been in the same age for quite a while. This wave started in 1971, exactly 50 years ago, with Intel and the creation of the microprocessor. Are we in the Frenzy phase with record amounts of investment capital, an enormous demand for early stage companies, and new financial innovations like Affirm’s debt securitizations? Or have we not gotten to the Frenzy phase yet? Is the public cloud or the iPhone the start of a new big bang and we have overlapping revolutions for the first time ever? Obviously identifying the truly breakthrough moments in technology history is way easier after the fact, so maybe we are too new to know what really is a seminal moment. Perez’s answer, though only a few words, fully provides scope to the question. Perez suggests we are still in the installation phase (Irruption and Frenzy) of the new technology and that makes a lot of sense. Sure, internet usage is incredibly high in the US (96%) but not in other large countries. China (the world’s largest country by population) has only 63% using the internet and India (the world’s second-largest country) has only 55% of its population using the internet. Ethiopia, with a population of over 100M people only has 18% using the internet. There is still a lot of runway left for the internet to bloom! In addition, only recently have people been equipped with a powerful computing device that fits in their pocket - and low-priced phones are now making their way to all parts of the world led by firms like Chinese giant Transsion. Added to the fact that we are not fully installed with this revolution, is the rise of populism, a political movement that seeks to mobilize ordinary people who feel disregarded by the elite group. Populism has reared its ugly head across many nations like the US (Donald Trump), UK (Brexit), Brazil (Bolsonaro) and many other countries. The rise of populism is fueled by the growing dichotomy between the elites who have benefitted socially and monetarily from the revolution and those who have not. In the 1890’s, anti-railroad sentiment drove the creation of the populist party. More recently, people have become angry at tech giants (Facebook, Google, Amazon, Apple, Twitter) for unfair labor practices, psychological manipulation, and monopolistic tendencies. The recent movie, the Social Dilemma, which suggests a more humane and regulatory focused approach to social media, speaks to the need for regulation of these massive companies. It is also incredibly ironic to watch a movie about how social media is manipulating its users while streaming a movie that was recommended to me on Netflix, a company that has popularized incessant binge-watching through UX manipulation, not dissimilar to Facebook and Google’s tactics. I expect these companies to get regulated soon -and I hope that once that happens, we enter into the Synergy phase of growth and value accruing to all people.

Yes, I do. I will find the time to reply to you properly. But just quickly, I think installation was prolonged by QE &casino finance; we are at the turning point (the successful rise of populism is a sign) and maybe post-Covid we'll go into synergy.

— Carlota Perez (@CarlotaPrzPerez) January 17, 2021

Business Themes

The role of Financial Capital in Revolutions. As the new technology revolutions play themselves out, financial capital appears right alongside technology developments, ready to mold the revolution into the phases suggested by Perez. In the irruption phase, as new technology is taking hold, financial capital that had been on the sidelines waiting out the Maturity phase of the previous revolution plows into new company formation and ideas. The financial sector tries to adopt the new technology as soon as possible (we are already seeing this with Quantum computing), so it can then espouse the benefits to everyone it talks to, setting the stage for increasing financing opportunities. Eventually, demand for financing company creation goes crazy, and you enter into a Frenzy phase. During this phase, there is a discrepancy between the value of financial capital and production capital, or money used by companies to create actual products and services. Financial capital believes in unrealistic returns on investment, funding projects that don’t make any sense. Perez notes: “In relation to the canal Mania of the 1790s, disorder and lack of coordination prevailed in investment decisions. Canals were built ‘with different widths and depths and much inefficient routing.’ According to Dan Roberts at the Financial Times, in 2001 it was estimated that only 1 to 2 percent of the fiber optic cable buried under Europe and the United States had so far been turned on.” These Frenzy phases create bubbles and further ingrain regulatory mismatch and political divide. Could we be in one now with deals getting priced at 125x revenue for tiny companies? After the institutional reckoning, the Technology revolution enters the Synergy phase where production capital has really strong returns on investment - the path of technology is somewhat known and real gains are to be made by continuing investment (especially at more reasonable asset prices). Production capital continues to go to good use until the technology revolution fully plays itself out, entering into the Maturity phase.

Casino Finance and Prolonging Bubbles. One point that Perez makes in her tweet, is that this current bubble has been prolonged by QE and casino finance. Quantitative easing is a monetary policy where the federal reserve (US’s central bank) buys government bonds issued by the treasury department to inject money into the financial ecosystem. This money at the federal reserve can purchase bank loans and assets, offering more liquidity to the financial system. This process is used to create low-interest rates, which push individuals and corporations to invest their money because the rate of interest on savings accounts is really really low. Following the financial crisis and more recently COVID-19, the Federal Reserve lowered interest rates and started quantitative easing to help the hurting economy. In Perez’s view, these actions have prolonged the Irruption and Frenzy phases because it forces more money into investment opportunities. On top of quantitative easing, governments have allowed so-called Casino Capitalism - allowing free-market ideals to shape governmental policies (like Reagan’s economic plan). Uninterrupted free markets are in theory economically efficient but can give rise to bad actors - like Enron’s manipulation of California’s energy markets after deregulation. By engaging in continual quantitative easing and deregulation, speculative markets, like collateralized loan obligations during the financial crisis, are allowed to grow. This creates a risk-taking environment that can only end in a frenzy and bubble.

Synergy Phase and Productive Capital Allocation. Capital allocation has been called the most important part of being a great investor and business leader. Think about being the CEO of Coca Cola for a second - you have thousands of competing projects, vying for budget - how do you determine which ones get the most money? In the investing world, capital allocation is measured by conviction. As George Soros’s famous quote goes: “It's not whether you're right or wrong, but how much money you make when you're right and how much you lose when you're wrong.” Clayton Christensen took the ideas of capital allocation and compared them to life investments, coming to the conclusion: “Investments in relationships with friends and family need to be made long, long before you’ll see any sign that they are paying off. If you defer investing your time and energy until you see that you need to, chances are it will already be too late.” Capital and time allocation are underappreciated concepts because they often seem abstract to the everyday humdrum of life. It is interesting to think about capital allocation within Perez’s long-term framework. The obvious approach would be to identify the stage (Irruption, Frenzy, Synergy, Maturity) and make the appropriate time/money decisions - deploy capital into the Irruption phase, pull money out at the height of the Frenzy, buy as many companies as possible at the crash/turning point, hold through most of the Synergy, and sell at Maturity to identify the next Irruption phase. Although that would be fruitful, identifying market bottoms and tops is a fool’s errand. However, according to Perez, the best returns on capital investment typically happen during the Synergy phase, where production capital (money employed by firms through investment in R&D) reigns supreme. During this time, the revolutionary applications of recently frenzied technology finally start to bear fruit. They are typically poised to succeed by an accommodating regulatory and social environment. Unsurprisingly, after the diabolic grifting financiers of the frenzy phase are exposed (see Worldcom, Great Financial Crisis, and Theranos), social pressures on regulators typically force an agreement to fix the loopholes that allowed these manipulators to take advantage of the system. After Enron, the Sarbanes-Oxley act increased disclosure requirements and oversight of auditors. After the GFC, the Dodd-Frank act mandated bank stress tests and introduced financial stability oversight. With the problems of the frenzy phase "fixed” for the time being, the social attitude toward innovation turns positive once again and the returns to production capital start to outweigh financial capital which is now reigned in under the new rules. Suffice to say, we are probably in the Frenzy phase in the technology world, with a dearth of venture opportunities, creating a massive valuation increase for early-stage companies. This will change eventually and as Warren Buffett says: “It’s only when the tide goes out that you learn who’s been swimming naked.” When the bubble does burst, regulation of big technology companies will usher in the best returns period for investors and companies alike.